Market Commentary

I am a little bit late getting this month’s commentary out. Sorry about that. With a couple of hurricanes coming through, it has been a little busy around here.

Many of you took the time to send well wishes and check on me and the family, which I greatly appreciate. For what it is worth, we are better than we deserve. We made it through both storms (Helene and Milton) with very minimal impact, which cannot be said for many of our extended neighbors. They could use your prayers (and donations if you are into that sort of thing. There are many ways to give, but one organization I have confidence in is here.)

Milton from the movie, “Office Space.”

“Even the sap is running up the trees…”

Markets continued their relentless climb in September, with the so-called Magnificent 7 leading the way, up 9.9% for the month. Meanwhile, the S&P 500 was only up 4.2%. What does that tell you about the other 493 stocks?

I am still no mathematician, but if 7 out of 500 stocks were up 9.9%, and the 500 as a group were up 4.2%, the other 493 were collectively a drag of 5.7%.

That brings the year-to-date return of the S&P 500 to 21%. And you can do similar math there. If the Magnificent 7 is up 44.1% this year, but the S&P 500 is only up 21.5% this year, the other 493 stocks are dragging the return down by more than 20%!

Some bull market!

(Click Imagine to Enlarge)

(Click Imagine to Enlarge)

As most of you know, I prefer the Top 10 to the “Mag” 7 because it is a little more objective. The Top 10 means the ten most valuable stocks in the index. Meanwhile, the financial media has taken to using the Mag 7, excluding Tesla, because Tesla is such a dog.

Tesla shares are still down about 50% from their all-time high achieved all the way back in early November 2021. That is back when electric vehicles were going to eliminate the need for internal combustion engine (ICE) vehicles overnight. At the time, Tesla was the only game in town, and there was virtually no competition. Nobody could envision a world where Tesla shares wouldn’t just keep climbing regardless of fundamental economics or the outrageous valuation… stop me when that starts sounding like today’s stock market darling, Nvidia!

Of course, that could never happen to Nvdia… (I hope you are catching the sarcasm)

Tesla may also fall out of the Top 10 soon. Today, Tesla’s market cap is about $700 billion and falling, while Wal-Mart's is $644 billion and rising… JP Morgan is also in the mix at $629 billion.

(Click Imagine to Enlarge)

The big news since last month is that the Fed actually cut its policy rate by 0.50% or 50 basis points on September 18th. These “less restrictive” conditions are designed to support the labor market and keep unemployment from rising too much. On the other hand, these conditions will also lead to higher inflation, all else equal.

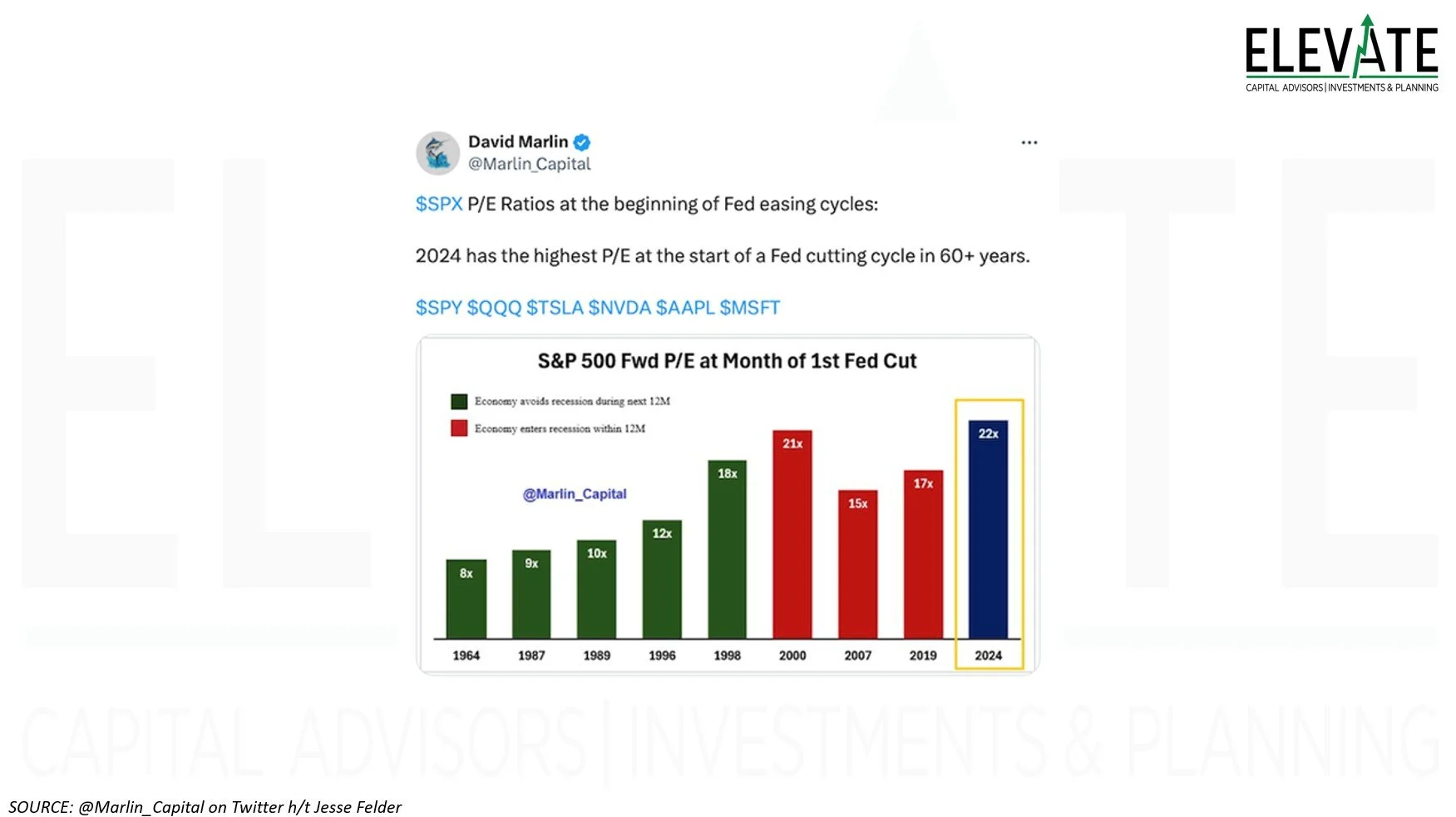

I discussed last month that the beginning of the past three rate cut cycles (going back to 2000) have all coincided with substantial market declines, even if not immediately. So far, the stock market has reacted favorably to the shift in policy. The bond market, on the other hand, not so much.

You might think that since the Fed cut its policy rate, economic interest rates have come down as well, but that has not been the case. T-bill rates (U.S. Treasuries maturing in less than one year) have come down from over 5% to around 4.5%, but 30-year fixed mortgage rates have risen from 6.09% to 6.32%, while both 2-year and 10-year treasury rates jumped by 10%!

Meanwhile, the money supply, as measured by “M2,” is once again rising, which is also inflationary, all else equal.

So, why is the Fed cutting rates and pumping more money into the economy when they know it will cause inflation to rise? If you listen to what they say, it is because they are worried about unemployment rising. And I think that is probably true – to a degree.

That said, unemployment is only slightly over 4%, which is already much lower than the 50-year average of 6%.

So, what else could be driving the decision? Could it be the massive amount of debt that the United States Treasury needs to refinance in the next 12 months? I bet that has A LOT to do with it!

Outlook

(Click Imagine to Enlarge)

Since the stock market is fundamentally expensive (to put it nicely) by any measure, my near-term outlook for the market is driven almost exclusively by technical analysis.

In response to the Fed’s rate cut, the S&P 500 broke out to a new all-time high and then “back tested” its former line of resistance, which is now support. It has bounced from there, and as we say in trading, “nothing but clear blue sky above.”

The next logical points of resistance are the “round numbers” of 5,900 and, more importantly, 6,000. It may sound crazy, but once something is already irrationally overpriced, there is no reason it can’t get even more expensive as market participants get FOMO and chase it higher still.

So, until we see the price breakdown below trend support (purple dashed line), just hang on for the ride.

As the wise Old Turkey says, “It’s a bull market, you know!”

Remember, inflation is good for stocks. The Fed’s current policies are inflationary. Government deficit spending is inflationary.

Slowing GDP and rising unemployment lead the Fed to cut rates. Lower rates lead to the U.S. Dollar losing value. Less valuable dollars lead to things that are priced in dollars costing more of the, i.e. the price goes up… this is inflation.

So, in times of inflation, we want to own things priced in dollars - things like stocks (particularly the capital-efficient kinds), gold, Bitcoin, real estate, commodities, etc.

Gold is still up more than both the S&P 500 and Nasdaq this year!

On the other hand, we want to own relatively fewer dollars (hold less cash) and capital-intensive companies that won’t grow without substantial ongoing expenditures.

By the next time I write to you, the election will be behind us, thank goodness. Before I share a few highlights from recent company earnings conference calls, I wanted to share with you a favorite essay of mine from the late P.J. O'Rourke titled “It Doesn’t Matter Who Wins.”

Before you email me to tell me how much it really does matter, please understand that I can enjoy the essay without necessarily agreeing entirely with its conclusion, just as I can remain very skeptical of our economy and stay aggressively long the stock market!

“I want to provide some additional context around what we're seeing and hearing from our customers. The majority of them state that they feel worse off financially than they were six months ago as higher prices, softer employment levels and increased borrowing cost have negatively impacted low-income consumer incentive.…our core customer says that they're feeling worse off financially than they did six months ago.”

-Todd Vasos, Dollar General CEO

Dollar General shares are down 35% from where they closed the day before the conference call.

“Our results reflect a challenging demand environment which was weaker than we expected, particularly in the U.S. domestic package market. Looking at our performance on a year-over-year basis, there are several factors at play. Weakness in the industrial economy pressure our business-to-business volumes, particularly in the U.S. We saw increasing demand for our lower-yielding services and some of this demand increase was driven by a shift in customer preference worldwide from priority to deferred services.”

-Raj Subramaniam, FedEX CEO

FedEx is a bellwether of economic activity. Shares dropped 15% on the news and have recovered only slightly.

“Customers continue adjusting to the current economic environment. The reduction of excess savings built up during the pandemic, higher interest rates, and the effect of inflation are pressuring customers' ability to spend. This is especially true for our most budget conscious customers, as we've been seeing for a while now. But we're now seeing other customer segments beginning to make changes as well.

Customers are purchasing lower price cuts of meat, buying less, and focusing on essentials. Budget conscious customers are buying more at the beginning of the month to stock up on essential items and groceries. And then as the month progresses, they are more cautious with their spending.”

-Rodney McMullen, Kroger Chairman & CEO

In case it doesn’t go without saying, “other customer segments” means higher-income customers.

Until next time, I thank God for each of you, and I thank each of you for reading this commentary.

Clients, I encourage you to click here to access your personalized performance portal to see how your portfolio performed vs. the markets last month.

Shane Fleury, CFA

Chief Investment Officer

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.