Wesley Chapel, FL

I am a little late in getting this month’s commentary out partly because our team got together this week for our annual Elevate meeting down in Fort Lauderdale. Since I am in a hurry to get this out I will bounce around between several topics without much thought to the transitions. But before moving on a couple pictures of the team.

Racing some fast go karts!

Indoor skydiving… I couldn’t particiapte due to some old hockey injuries to my shoulders. ☹

And then there were six…

For the past year or more, the so-called Magnificent Seven stocks have driven the vast majority of the S&P 500’s return. Those are the seven largest companies by market cap that also just so happen to have gone up A LOT. The stocks are Apple (AAPL), Microsoft (MSFT) Alphabet (GOOG), Amazon (AMZN) Meta Platforms (META), Nvidia (NVDA) and Tesla (TSLA).

Tesla stock is actually down almost 11% over the past year.

That said, Tesla has started the year down about 25% and the talking heads have begun referring to the rest of the group as… wait for it… The Magnificent Six… I couldn’t make it up if I tried.

What changed for Tesla? Nothing, really. I think the market has just gradually noticed how overpriced the stock was and from there market “gravity” took care of the rest, as it always eventually does.

Of course, this could never happen to the other members of the “Mag 7…” That was sarcasm if you didn’t pick it up…

Some of the talking heads like their Magnificent Seven moniker so much though that they advocate for putting a new name into the group. Berkshire Hathaway and Eli Lilly both now carry a higher market cap than Tesla. 🤷♂️

For now, the Magnificent Seven still includes Tesla.

Amazingly, even with Tesla included (it is still the 9th largest company by market cap) and Apple also being down 5% so far in 2024, these seven stocks are still carrying the S&P 500. The index is once again far outpacing the Equal-Weight version of the index, which as of last night’s close of business was actually down in 2024.

What this tells us is that the average stock in the S&P 500 isn’t doing very well. If you shorted an equal amount of every stock in the index on New Years Eve, you’d be up YTD.

Nifty Fifty

As we often say, history doesn’t necessarily repeat exactly but it often rhymes… Well, many of you have been around long enough to remember the Nifty Fifty. For those of you (us) who are lucky enough to not have been, a brief recap goes something like this…

The term Nifty Fifty was an informal designation for a group of roughly fifty large-cap stocks on the New York Stock Exchange in the 1960s and 1970s that were widely regarded as solid buy and hold growth stocks, or "Blue-chip" stocks.

The stocks were often described as "one-decision", as they were viewed as extremely stable, even over long periods of time.

The most common characteristic by the constituents were solid earnings growth for which these stocks were assigned extraordinary high price–earnings ratios. Trading at fifty times earnings or higher was common, far above the long-term market average of about 15 to 20.

Source: Wikipedia

Sound familiar? I bet you can guess what happened next… that’s right, they largely underperformed for decades.

While many of the stocks in the original group do in fact still exist and remain excellent businesses (Coca-Cola, Merck, American Express, etc), many have gone absolutely nowhere for years, and several (Polaroid, Kodak, Sears, JC Penney) have gone bankrupt.

Remember, these were the “sure things” of their time – just like the Mag 7 is today. You could just buy them without consideration of their fundamental value and hold them forever.

Rate Cuts

Coming into the year the futures market was pricing in a 100% chance that the Fed would cut interest rates at their meeting in March. By the time inflation data for December was reported in January, the chances of a March rate cut had dropped to 60%. Then the inflation data for December came in higher than expected… the chances of a rate cut in March should have dropped to 0%, but they didn’t move. It was inexplicable. The market wants their cut and they want it now!

Fast forward to today, the day after inflation data for January 2024 was reported also higher than expected, and the chances of a rate cut in March are finally zero. In fact, the first fully priced in cut according to the futures market is now July… not even May or June. It seems like someone is finally paying attention. This of course led all the major indexes to be down yesterday, led by the Russell 2000 which was down a whopping 4% on the day. The S&P 500 and Nasdaq were down less (thanks to the Mag 7, of course) but both still lost over 1%.

Even after those drops, the market seems extremely complacent, overall. The economic risks won’t matter – until they do.

Even with the rate cut expectations being dialed back a little bit over the past couple days, the market is still expecting more than the Fed has communicated. How the market will react when the cuts finally do come? I expect it will be yet another case of “buy the rumor, sell the news,” where stocks get bought in anticipation of the event, but once the event happens everyone who wants to buy has already bought and all that remain are sellers, which inevitably drives prices lower… usually in a hurry. It feels a lot like the musical chairs game actually… We all know the music will stop at some point - we just don’t know when.

U.S. Debt is Unsustainable

We are over $34 Trillion in national debt (I half expected it to have gone over $35 Trillion by the time I wrote this but thankfully it hasn’t) and as I have noted, this money will never be paid back… certainly not in today’s dollars. The only way to pay this money back is to print the money to do it with, thus making each dollar in circulation worth less… hopefully not worthless. Check out this quick video from our friends at Hedgeye.

As long-time clients and readers know, the best business in the world is Property & Casualty Insurance. It is the only business in the world that has a positive cost of capital. This means that if they can underwrite profitably, they are effectively getting paid to invest the premiums paid by their customers – and the company gets to keep the investment profits, too. It’s truly an amazing business. But underwriting is hard, and not all companies are great at it. WR Berkley (the longest held position in the Elevate Capital Strategy) is one of the greatest. The company was essentially started in a dorm room at Harvard by Bill Berkley (William Robert “WR” Berkley), who remains the Chairman, and whose son now runs the company as its CEO. Bill (if I may be so bold to refer to the legend by his first name) still gets on the quarterly conference calls and will occasionally answer a question if he deems it worthy. On their recent call from January 24th, Mike Zaremski, an analyst at BMO Capital asked:

“Maybe if I can sneak one last one in, if Bill thinks it's a question worthy of his wisdom. [In a] presidential election year, to the extent the outcome is for a change of the guard, is there anything market-wise, investment portfolio-wise, or just interest rate-wise you guys are thinking of in terms of hard or dry or pivot? If that is an outcome late this year.”

Bill elected to respond:

“So long as you have Congress keep extending the debt limit and doing deals because they’re afraid of the consequences of doing the right thing... eventually you’re going to have a debt spiral. And a debt spiral is like a death spiral.”

“So, I think the bottom line is, we got a two trillion-dollar deficit. 92% of the world’s countries have deficits. There is going to be an enormous demand for money. Number two, we are the only significant democratic country that doesn't have any kind of national sales tax. We have some flexibility.

However, you have to look at every time there has been a need to come to a conclusion, Democrat or Republican the conclusion has been both parties spend more money. So, what that tells you is spending money and not having taxes go up are a cornerstone of the policies both parties have chosen to follow.

At some point, we're going to have to decide, someone is going to have to pay for what we're doing. And, whether that's a value-added tax or increasing income taxes or whatever, we are going to have to do something, and it's going to happen during the next presidential period, or Social Security and Medicare, Medicaid are going to be in jeopardy.

So, I don't think it matters who is elected. That's a problem that we're going to face. It won't happen until after the election. Whoever is elected won’t matter. And I think what that's going to mean is we're going to have some pressure on inflation, pressure on government spending and, I don't think that means good things for interest rates coming down. I would expect interest rates at best will be flat.

I think people are biased by the fact that we had an extended period with extraordinarily low-interest rates. I don't think interest rates are going to go crazy, but I don't, I don't think we're going to see them consequentially lower than they are, probably a little higher.”

How does inflation work?

Overall prices in the economy do not rise because of supply chains or any exogenous factor. If the supply of money and the velocity of money remained constant, an increase in the price of any one item would actually push the prices of all other items down as the money to pay for the increase would have to come at the expense of the other items collectively.

The true cause for inflation across the economy is new money coming into supply, or an increase in the velocity of that money, or both. Any time the government spends more money than it receives in taxes, there is new supply of money.

The impacts of inflation are cumulative.

If prices rise by 9%, then by 3%... the absolute price increase from the base year is 12.27%... If something cost $100 at the beginning it costs $109 after the first year. Then, when the cost of $109 increases by 3% the thing that used to cost $100 now costs $112.27.

If I gain 9lbs this year, and then next year I gain 3lbs, did I lose any weight next year? Nope. I just gained less than the year before, but I am still 12lbs heavier!

It’s the same idea when people out there say “inflation is falling.” That doesn’t mean prices are going down, as anyone who has bought anything in the past year knows intuitively. It doesn’t take an economics degree to figure this stuff out.

To get out there and say that “inflation has been whipped,” as U.S. Treasury Secretary Janet Yellen seems to believe, totally ignores the economic reality of all the citizens who aren’t in the top 10% of income earners in the United States and are struggling to keep up with rising prices. How many people is that? I am no mathematician but 90% of 300 million people is 270 million people… otherwise known as A LOT.

Reasons to Be Bullish

There are always reasons to be bullish… some reasons are better than others but there are always reasons nonetheless.

The data says that good years tend to beget good years. Annual gains of 20% aren’t all that rare for the stocks in the United States, in fact, since 1950, we’ve seen 21 years of 20% gains. Setting all fundamental data aside and looking at returns in a vacuum, the data also says that stocks tend to rise in the calendar year after a 20% gain, too, by 10% or more half the time. The probability of the market rising (by any amount) in the subsequent year is 80%, which is slightly better than the probability of the market rising in any year of about 73%.

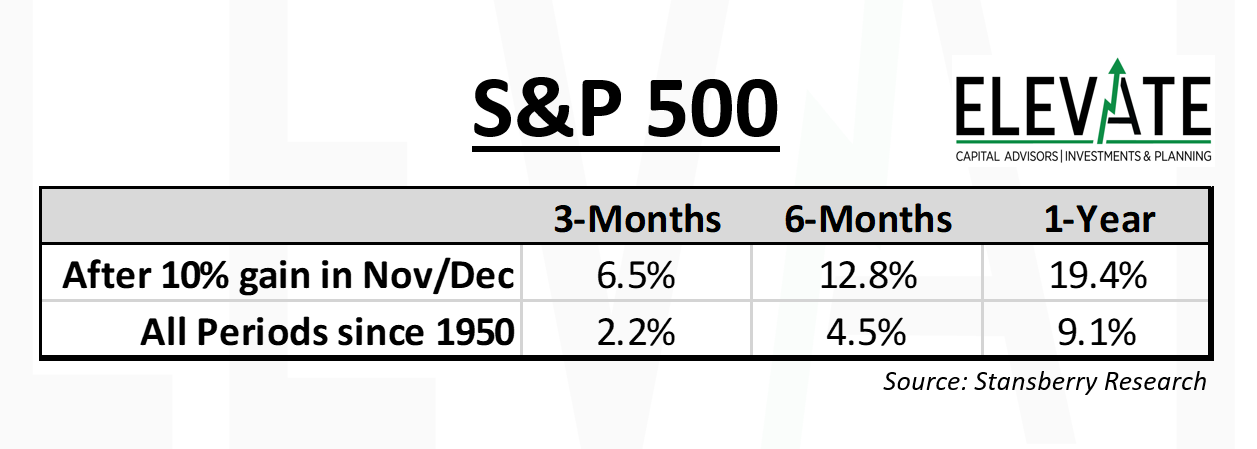

Taking it one step further, we see that when the S&P 500 rallies by 10% or more in November and December alone, it is even more likely to be up in subsequent periods.

Granted, this is a relatively small sample size of only 10 occurrences, but the data is clear. And what’s more, the market was up 100% of the time the year after these occurrences by an average of 11% - better than the annual average of 9.1% since 1950.

What is the consensus today? Where could it be wrong?

It is worth reading in its entirety and you can click here to do just that, but I wanted to share at least the conclusion Howard Marks reached in his recent memo:

Eighteen months ago, it was near-universally accepted that the Fed’s aggressive program of rate increases would result in a recession in 2023. That was wrong.

Twelve months ago, the optimists who launched the current stock market rally were motivated by their belief that the Fed would pivot to dovishness and start cutting rates in 2023. That was wrong.

Six months ago, there was a consensus that there would be one more rate increase in late 2023. That was wrong.

I find it interesting that the current stock market rally began as a result of optimism powered by consensus thinking that was generally off target. (See the second bullet point just above.)

At present, I believe the consensus is as follows:

Inflation is moving in the right direction and will soon reach the Fed’s target of roughly 2%.

As a consequence, additional rate increases won’t be necessary.

As a further consequence, we’ll have a soft landing marked by a minor recession or none at all.

Thus, the Fed will be able to take rates back down.

This will be good for the economy and the stock market.

“The Manchester banker John Mills commented perceptively [in 1865] that “as a rule, panics do not destroy capital; they merely reveal the extent to which it has previously been destroyed by its betrayal into hopelessly unproductive works.”

Before going further, I want to note that, to me, these five bullet points smack of “Goldilocks thinking”: the economy won’t be hot enough to raise inflation or cold enough to bring on an economic slowdown. I’ve seen Goldilocks thinking in play a few times over the course of my career, and it rarely holds for long. Something usually fails to operate as hoped, and the economy moves away from perfection. One important effect of Goldilocks thinking is that it creates high expectations among investors and thus room for potential disappointment (and losses).

Some more consensus thinking I see out there today:

The Magnificent 7 stocks are the best companies in the world to buy right now.

They will obviously keep growing at permanently high rates thanks to AI.

Meanwhile, the Russell 2000 is in an earnings depression, never mind a recession.

Five consecutive quarters of declining earnings seems to qualify as a depression – and look at this quarter, -33% from a year ago. Just terrible. Yet every time the Russell rises, we get the talking heads promoting a “broadening” rally… they have been wrong every time. Eventually, they’ll get it right if they stick with it but for now, the 2,000 stocks in the Russell are in full-on crash mode from an earnings perspective.

Office Space Loans Going Bad

New York Community Bank (NYCB) dropped as much as 46% when it reported earnings for the 4th quarter, and took a substantial write down of $185 million due in large part to one office loan going “non-accrual.” That means no payment has been made for 90 days, or more. The stock proceeded to drop even further over the next several days falling more than 65% from where it closed prior to the earnings release. Keep in mind this is the bank that took over Signature Bank New York, which of course failed less than a year ago… but everything is fine with the banking system!

The day after NYCB released its earnings, another bank, this time one based in Japan reported similar results… why does this matter? Well, the massive write down it took was due to Commercial Real Estate in the United States… Go figure.

These two banks aren’t alone… Small Banks in the United States are over-exposed to commercial real estate, especially when compared to their large bank counterparts. The chart below shows you just how extreme things are. It’s actually terrifying.

Small bank commercial real estate loans have rocketed higher as a percentage of bank assets. What could possibly go wrong?

And finally, a couple highlights from the recent Hussman Market Comment:

Recall that the S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period. When the investment horizon begins at extreme valuations, and doesn’t end at the same extremes, the retreat in valuations acts as a headwind that consumes the return that would otherwise be provided by dividends and growth in fundamentals.

– John P. Hussman, Ph.D.The total return of the S&P 500 remains behind Treasury bills since its January 2022 peak more than two years ago. Meanwhile, the technology-heavy Nasdaq 100 is only even with Treasury bills since the preponderance of warning flags I noted in our November 2021 comment...

– John P. Hussman, Ph.D.

Focus on what the market (and the Fed) will do, not what they should do.

Readers might assume that because I have been bearish that we aren’t making any money. Nothing could be further from the truth.

I can be both bearish, and aggressively long stocks, as we are in our Elevate Capital Strategy (and the aggressive versions of our passive strategies). Our strategy performance has recently proven this (that we can both be bearish and make money) as they have gotten off to a great start to 2024 after a very strong second half of 2023. And so, I will continue to pay close attention to the economic realities we face, even as the market climbs the proverbial “wall of worry.”

Until next time, I thank God for each of you, and I thank each of you for reading this commentary.

Clients, I encourage you to click here to access your personalized performance portal to see how your portfolio performed vs. the markets last month.

Shane Fleury, CFA

Chief Investment Officer

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.